Cost rollup policy and overhead calculation

Cost accounting lets you gain insight into how the cost flow relates to the products and services that are delivered within an organization. To see the cost transparency, it's crucial to achieve cost allocation between cost objects based on an appropriate allocation basis. By default, the cost allocation is achieved for the primary cost element, which is desired in some situations, but it has a few implications that should be considered.

- Auxiliary cost objects will end with a zero balance for the primary cost element after overhead calculation.

- The volume of cost entries generated by overhead calculation can be very high.

- It is not possible to track the cost flow between cost objects.

To avoid these implications, Cost accounting lets you configure cost allocation to fit into your organization managerial reporting requirements. This article discusses how you can determine the correct level of secondary cost elements and create cost rollup rules that fit into organization reporting and cost traceability.

Note

You can change configurations if reporting requirements change.

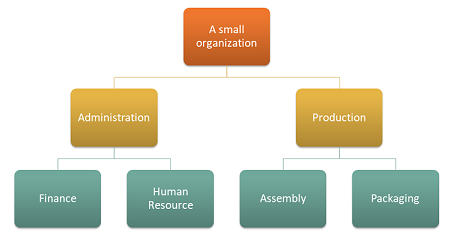

Example of cost rollup policy setup

Imagine that an organization has the following structure with 4 cost centers.

Cost object dimension

| Cost centers | Description |

|---|---|

| CC001 | HR |

| CC002 | Finance |

| CC003 | Assembly |

| CC004 | Packaging |

Cost element dimension

| Cost elements | Description | Type |

|---|---|---|

| 1001 | Electricity | Primary |

| 1002 | Salaries | Primary |

| 1003 | Advertising | Primary |

A dimension hierarchy that fulfills the organizational reporting requirements can be set up as follows.

Dimension hierarchy details

| Dimension hierarchy name | Dimension | Dimension hierarchy type name | Access list hierarchy |

|---|---|---|---|

| Organization | Cost centers | Dimension classification hierarchy | No |

Dimension hierarchy

| Dimension member ranges | ||

|---|---|---|

| Nodes | From dimension member | To dimension member |

| Organization | ||

| Admin | ||

| Finance | CC001 | CC001 |

| HR | CC002 | CC002 |

| Production | ||

| Packaging | CC003 | CC003 |

| Assembly | CC004 | CC004 |

A dimension hierarchy that fulfills the policy requirement can be set up as follows.

Dimension hierarchy details

| Dimension hierarchy name | Dimension | Dimension hierarchy type name |

|---|---|---|

| Profit & Loss statement | Cost elements | Dimension classification hierarchy |

Dimension hierarchy

| Dimension member ranges | ||

|---|---|---|

| Nodes | From dimension member | To dimension member |

| Profit & Loss statement | ||

| Primary cost | 10001 | 10003 |

After the general ledger entries are processed, the cost entry balance by cost object looks like this.

| Cost object | Total | ||||

|---|---|---|---|---|---|

| Cost element | CC001 | CC002 | CC003 | CC004 | |

| 1001 Electricity | 100,00 | 200,00 | 6.000,00 | 2.000,00 | 8.300,00 |

| 1002 Salaries | 10.000,00 | 10.000,00 | 8.000,00 | 6.500,00 | 34.500,00 |

| 1003 Advertising | 0,00 | 4.000,00 | 0,00 | 0,00 | 4.000,00 |

| 10.100,00 | 14.200,00 | 14.000,00 | 8.500,00 | 46.800,00 |

Statistical dimension

| Statistical elements | Description |

|---|---|

| SE-1 | HR services |

| SE-2 | Finance services |

Cost object CC001 HR is contributing HR services to several cost objects.

HR services are consumed by the following distribution of magnitude.

| Cost object | Description | HR services |

|---|---|---|

| CC002 | Finance | 35 |

| CC003 | Assembly | 55 |

| CC004 | Packaging | 10 |

Cost object CC002 Finance is contributing to several cost objects.

Finance services are consumed by the following distribution of magnitude.

| Cost object | Description | Finance services |

|---|---|---|

| CC003 | Assembly | 65 |

| CC004 | Packaging | 35 |

Cost allocation polices can be set up as follows.

| Policy name | Description | Cost object dimension hierarchy | Statistical dimension | Cost element dimension |

|---|---|---|---|---|

| 2017 | Cost allocation | Organization | Statistical elements | Cost elements |

Cost allocation rules can be set up as follows.

| Cost object dimension hierarchy node | Cost behavior | Allocation base |

|---|---|---|

| CC001 | Total | HR services |

| CC002 | Total | Financial services |

How cost flows between cost centers

If you want to learn how cost flows between the cost centers in the organization, you can create cost elements of the type Secondary for each cost center. These cost elements will then be used to transfer balances between the cost centers during the overhead calculation.

Cost element dimension members can be set up as follows.

| Cost elements | Type | |

|---|---|---|

| 1001 | Electricity | Primary |

| 1002 | Salaries | Primary |

| 1003 | Advertising | Primary |

| SC-CC001 | HR | Secondary |

| SC-CC002 | Finance | Secondary |

| SC-CC003 | Assembly | Secondary |

| SC-CC004 | Packaging | Secondary |

The dimension hierarchy Profit & Loss statement needs to be updated with the new dimension members so that the dimension hierarchy contains the correct data that can be used for defining reporting and policies.

Dimension hierarchy details

| Dimension hierarchy name | Dimension | Dimension hierarchy type name |

|---|---|---|

| Profit & Loss statement | Cost elements | Dimension classification hierarchy |

Dimension hierarchy

| Dimension member ranges | ||

|---|---|---|

| Nodes | From dimension member | To dimension member |

| Profit & Loss statement | ||

| Primary cost | 10001 | 10003 |

| Secondary cost | SC-CC001 | SC-CC004 |

Create a Cost rollup policy where each cost center is mapped to a corresponding cost element of the type Secondary.

Cost rollup polices

| Policy name | Description | Cost object dimension hierarchy | Cost element dimension hierarchy |

|---|---|---|---|

| 2017 | Cost flow | Organization | Profit & Loss statement |

Cost rollup rules

| Cost object dimension hierarchy node | Cost element dimension hierarchy node | Secondary cost element |

|---|---|---|

| CC001 | Profit & Loss statement | SC-CC001 |

| CC002 | Profit & Loss statement | SC-CC002 |

| CC003 | Profit & Loss statement | SC-CC003 |

| CC004 | Profit & Loss statement | SC-CC004 |

Perform overhead calculation

Journal

| Journal | Journal type | Fiscal calendar period | Year | Period | Version |

|---|---|---|---|---|---|

| 00002 | Cost allocation journal | Fiscal | 2017 | Period 1 | Overhead calculation / 01-02-2017 11:51:00 PM / Ledger /2017 / Period 1 |

The system will now apply the Cost rollup policy when it creates the Cost object balance journal entries.

Cost object balance journal entries

| Accounting date | Cost object | Description | Cost element | Description | Amount |

|---|---|---|---|---|---|

| 31-01-2017 | CC001 | HR | SC-CC001 | HR | 10.100,00 |

| 31-01-2017 | CC002 | Finance | SC-CC002 | Finance | 17.735,00 |

| 31-01-2017 | CC003 | Assembly | SC-CC003 | Assembly | 31.082,75 |

| 31-01-2017 | CC004 | Packaging | SC-CC004 | Packaging | 15.717,25 |

Note

The journal entries are created based on the rules in the Cost rollup policy if a policy exists. The balance displayed is the balance of the overhead calculation.

The Cost object cost balance journal entry details page that is accessed from the journal entries displays how the balance is obtained.

Example: The journal entry for Cost object CC002 Finance

Cost object cost balance journal entry details

| Cost element dimension member | Description | Amount |

|---|---|---|

| 1001 | Electricity | 200,00 |

| 1002 | Salaries | 10.000,00 |

| 1003 | Advertising | 4.000,00 |

| SC-CC001 | HR | 3.535,00 |

Cost entries generated by the Overhead calculation

| Cost object | Description | Cost element | Description | Amount | Accounting date |

|---|---|---|---|---|---|

| CC001 | HR | SC-CC001 | HR | -10.100,00 | 31-01-2017 |

| CC002 | Finance | SC-CC001 | HR | 3.535,00 | 31-01-2017 |

| CC003 | Assembly | SC-CC001 | HR | 5.555,00 | 31-01-2017 |

| CC004 | Packaging | SC-CC001 | HR | 1.010,00 | 31-01-2017 |

| CC002 | Finance | SC-CC002 | Finance | -17.735,00 | 31-01-2017 |

| CC003 | Assembly | SC-CC002 | Finance | 11.527,75 | 31-01-2017 |

| CC004 | Packaging | SC-CC002 | Finance | 6.207,25 | 31-01-2017 |

After the Overhead calculation is completed, you can report the results using tools such as Microsoft SharePoint Workspace, Excel, or Power BI.

View reporting in Excel

The dimension hierarchies allow you to view data at different aggregation levels.

Here is an example of a Power Pivot reporting in Excel.

| Profit & Loss statement | Cost object | Total | |||

|---|---|---|---|---|---|

| CC001 | CC002 | CC003 | CC004 | ||

| Primary cost | 10.100,00 | 14.200,00 | 14.000,00 | 8.500,00 | 46.800,00 |

| 1001 | 100,00 | 200,00 | 6.000,00 | 2.000,00 | 8.300,00 |

| 1002 | 10.000,00 | 10.000,00 | 8.000,00 | 6.500,00 | 34.500,00 |

| 1003 | 0,00 | 4.000,00 | 0,00 | 0,00 | 4.000,00 |

| Secondary cost | -10.100,00 | -14.200,00 | 17.082.75 | 7.217,25 | 0,00 |

| SC-CC001 | -10.100,00 | 3.535,00 | 5.555,00 | 1.010,00 | 0,00 |

| SC-CC002 | 0,00 | -17.735,00 | 11.527,75 | 6.207,25 | 0,00 |

| SC-CC003 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 |

| SC-CC004 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 |

| Total | 0,00 | 0,00 | 31.082,75 | 15.717,25 | 46.800,00 |

Using Cost rollup policy and Cost elements of the type secondary allows you to leave the primary cost per cost object for internal reporting as the primary cost that remains after Overhead calculation.

If the same example had been performed without creating the Cost rollup policy, the reporting result would be as shown below. The cost flows correctly but the traceability and insight into how cost flows between the cost centers are lost.

| Profit & Loss statement | Cost object | Total | |||

|---|---|---|---|---|---|

| CC001 | CC002 | CC003 | CC004 | ||

| Primary cost | 0,00 | 0,00 | 31.082,75 | 15.717,25 | 46.800,00 |

| 1001 | 0,00 | 0,00 | 6.207,75 | 2.092,25 | 8.300,00 |

| 1002 | 0,00 | 0,00 | 22.275,00 | 12.225,00 | 34.500,00 |

| 1003 | 0,00 | 0,00 | 2600,00 | 1.400,00 | 4.000,00 |

| Secondary cost | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 |

| SC-CC001 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 |

| SC-CC002 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 |

| SC-CC003 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 |

| SC-CC004 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 |

| Total | 0,00 | 0,00 | 31.082,75 | 15.717,25 | 46.800,00 |

Depending on the reporting and traceability requirements in your organization, you can determine the correct level of secondary cost elements and create cost rollup rules that fit your needs.

The clear separation between Cost allocation and Cost rollup policies provides the flexibility to make continuous updates without affecting each other.

Additional resources

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for