View and download tax documents for your Azure invoice

You can download tax documents for your Azure invoice if you have access to invoices in the Azure portal. Only certain roles have access to invoices, such as the Account Administrator. If you have a Microsoft Customer Agreement, you must be a Billing profile Owner, Contributor, Reader, or Invoice manager to download invoices and tax documents. If you have Microsoft Partner Agreement, you must have the Global Admin or Admin Agent role in the partner organization. Check your billing account type to see what permissions you need to download tax documents.

View and download tax documents

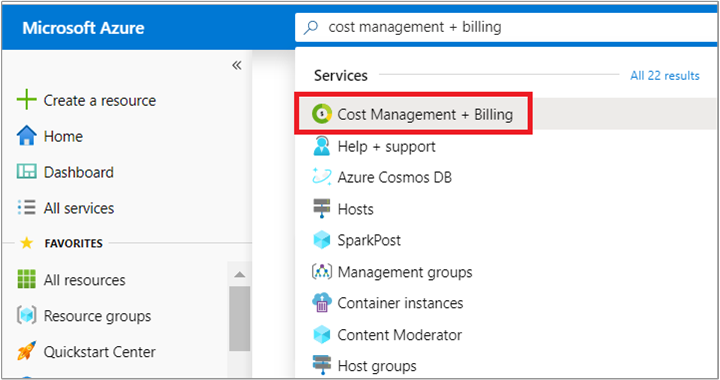

- Sign-in to the Azure portal.

- Search for Cost Management + Billing.

- Depending on your access, you might need to select a Billing account or Billing profile.

- In the left menu, select Invoices under Billing.

- In the invoice grid, find the row of the invoice corresponding to the tax document you want to download.

- Select the download icon or the ellipsis (

...) at the end of the row. - Select Tax document in the download menu. Depending on the country/region of your billing profile, you might see more than one tax document per invoice.

Check billing account type

- Sign in to the Azure portal.

- Search for Cost Management + Billing.

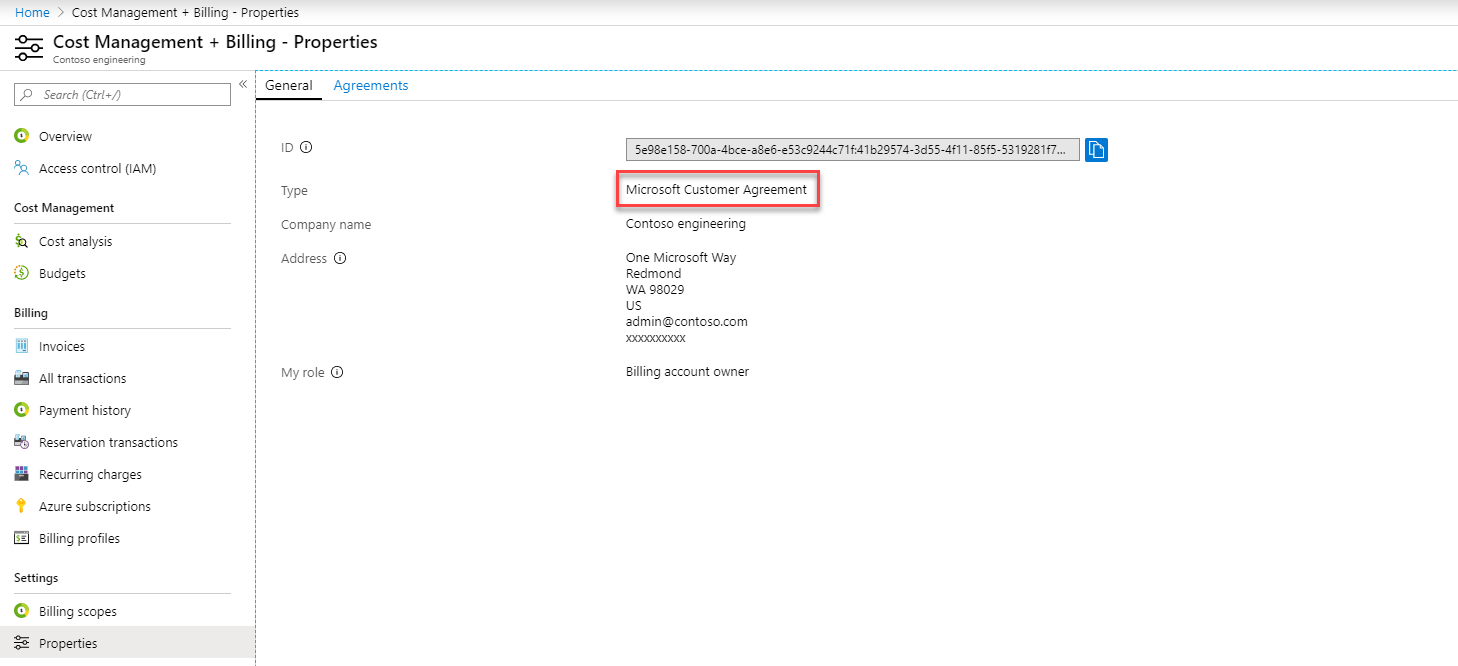

- If you have access to just one billing scope, select Properties from the left-hand side.

The Billing account type on the properties page determines the type of your account. It can be Microsoft Online Service Program, Enterprise Agreement, Microsoft Customer Agreement, or Microsoft Partner Agreement. To learn more about the type of billing accounts, see View your billing accounts in Azure portal.

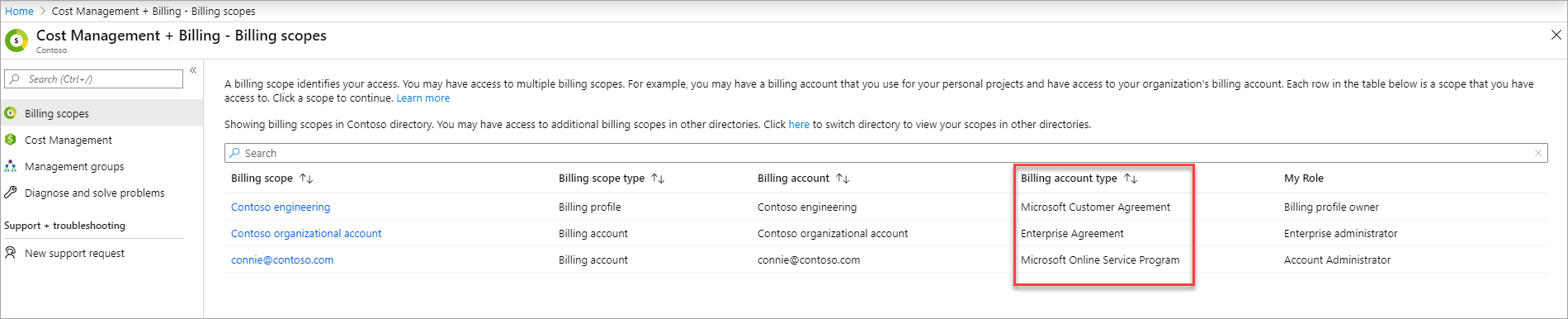

The Billing account type on the properties page determines the type of your account. It can be Microsoft Online Service Program, Enterprise Agreement, Microsoft Customer Agreement, or Microsoft Partner Agreement. To learn more about the type of billing accounts, see View your billing accounts in Azure portal. - If you have access to multiple billing scopes, check the type in the Billing account type column.

Related content

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for